Gold Based IRA – Gold Based IRA

Earlier than choosing an gold IRA custodian, you’ll wish to analysis the fame of the agency. Whereas it notes that most of the jobs are exterior Scotland, 10% of Aberdeen jobs are reckoned to be straight oil-dependent, and 5% in Aberdeenshire. 5. Proceed selling covered calls, till finally the options are exercised and the shares are sold. Citigroup predicts gold prices could surge to a new file excessive at some point throughout the next 12 months or two.

Earlier than choosing an gold IRA custodian, you’ll wish to analysis the fame of the agency. Whereas it notes that most of the jobs are exterior Scotland, 10% of Aberdeen jobs are reckoned to be straight oil-dependent, and 5% in Aberdeenshire. 5. Proceed selling covered calls, till finally the options are exercised and the shares are sold. Citigroup predicts gold prices could surge to a new file excessive at some point throughout the next 12 months or two.

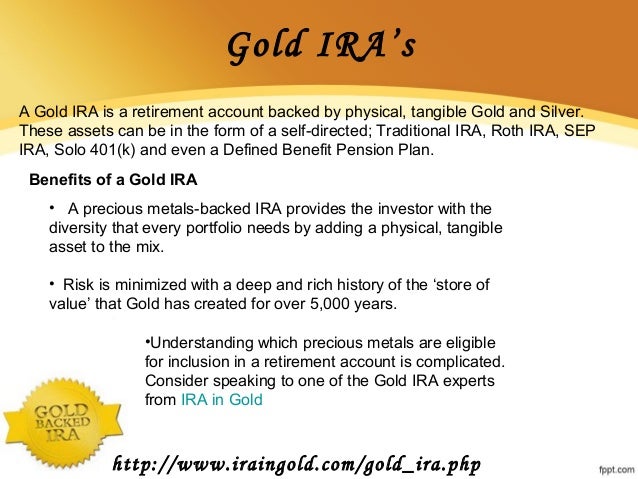

Simple IRA plans will need to have an annual election interval extending from November 2 to December 31. A plan can have extra election durations every year in addition to this 60-day election period. American Hartford Gold skillfully guides clients on how to maneuver in the direction of a extra secure future with the addition of secure-haven property to their funding portfolio. • Self-directed treasured metallic individual retirement accounts permit you to buy gold and silver to assist diversify your investments, achieving a more balanced portfolio. Its prospects can rely on excessive-quality guidance from the company's experts to ensure that they've access to the very best information that's essential to making knowledgeable selections. The desk beneath shows the ten best gold IRA companies.

This site is learn by buyers from everywhere in the world. Because Bitcoin is being hailed as The new Gold, we cover bitcoin’s use as an funding in detail in our bitcoin section – in spite of everything if we can now add bitcoin in our IRAs and even buy physical bitcoins with their digital value hidden inside a secret key, they might appear to be a direct rival for gold coins. gold ira companies ’ll assign you a dedicated Gold Alliance team member to assist you in selecting the best IRA custodian for you. To assist information you on your path, we’ll share information about gold IRA rollover and switch options below. Savvy affiliate marketers have discovered that they will create fake “review” web sites the place they “independently” consider gold IRA companies after which sell your info to the best bidder. Affiliate Disclosure: The owners of this web site may be paid to advocate these high gold funding corporations. open a gold ira should name and communicate with a representative, which is usually a trouble when comparing pricing among multiple companies. ESMA: CFDs are complex devices and include a excessive danger of shedding money rapidly on account of leverage. As said, gold ira companies for an IRA account should be held by an authorized depository.

The custodian handles IRS reporting, withdrawals, and transactions inside accounts like IRAs, from conventional via self-directed IRAs. To begin with, your current retirement account custodian is going to send you a distribution test. Custodians must adjust to the capital requirements and security protocols beneath the law at the federal and state levels and should be topic to state auditors. Anticipate to pay about 3% to 5% increased than the spot worth in your steel. Present your personal data, then await a group member to assist you the remainder of the way. In the long term, it may save you some huge cash. The important thing thing to remember is to purchase only bullion that is marked as ‘IRA-compatible’ or ‘IRS-approved’. Buying gold doesn’t essentially imply you’ll see any profit in your preliminary funding, and you may lose cash if you have to promote when the value is lower than when you purchased it. Administrator or initial setup fee: The first account setup expense is a one-time fee for processing paperwork and allowing you to arrange with a brand new Gold IRA account. Augusta's strength is its easy setup help to ensure that prospects can set up their Gold and Silver IRAs easily. Setting up the LLC and getting all the paperwork in order so that it actually ends up being a fruitful enterprise does incur fees.